cryptocurrency tax calculator us

In a Roth IRA your deposits are. This means you can get your books.

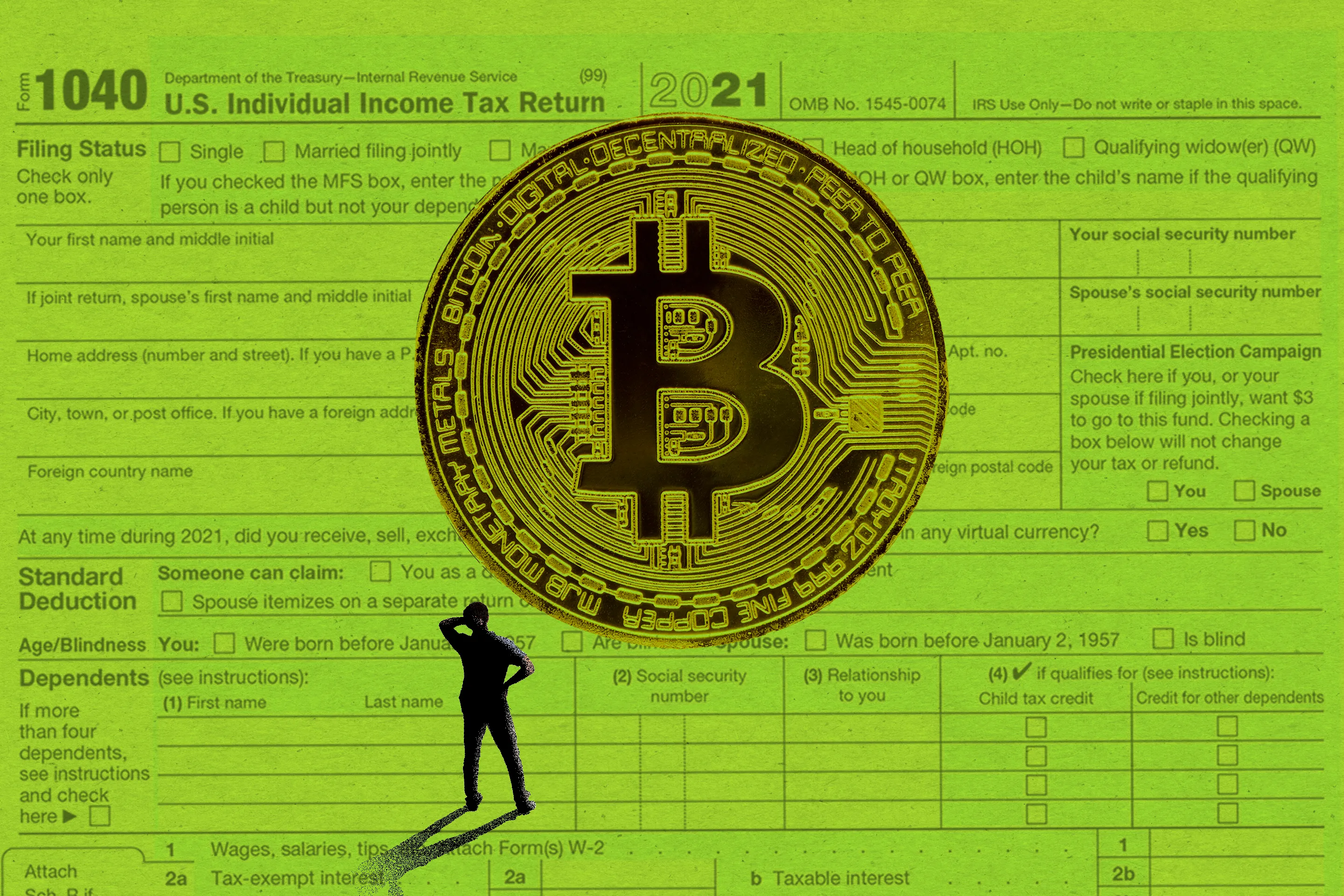

Cryptocurrency Taxes What To Know For 2021 Money

Cost price April 3000.

. The cryptocurrency tax calculator is available on the Fisdom website under the tab Resources on the homepage. You simply import all your transaction history and export your report. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash. The resulting numbers are based on your investing. Side by side Tax Calculate on Every Profit.

All you have to do is calculate the total tax owed on cryptocurrency according to your total. In this case youll need to report your capital gains and losses on your tax return using Schedule D. No Installation required Just one file opens.

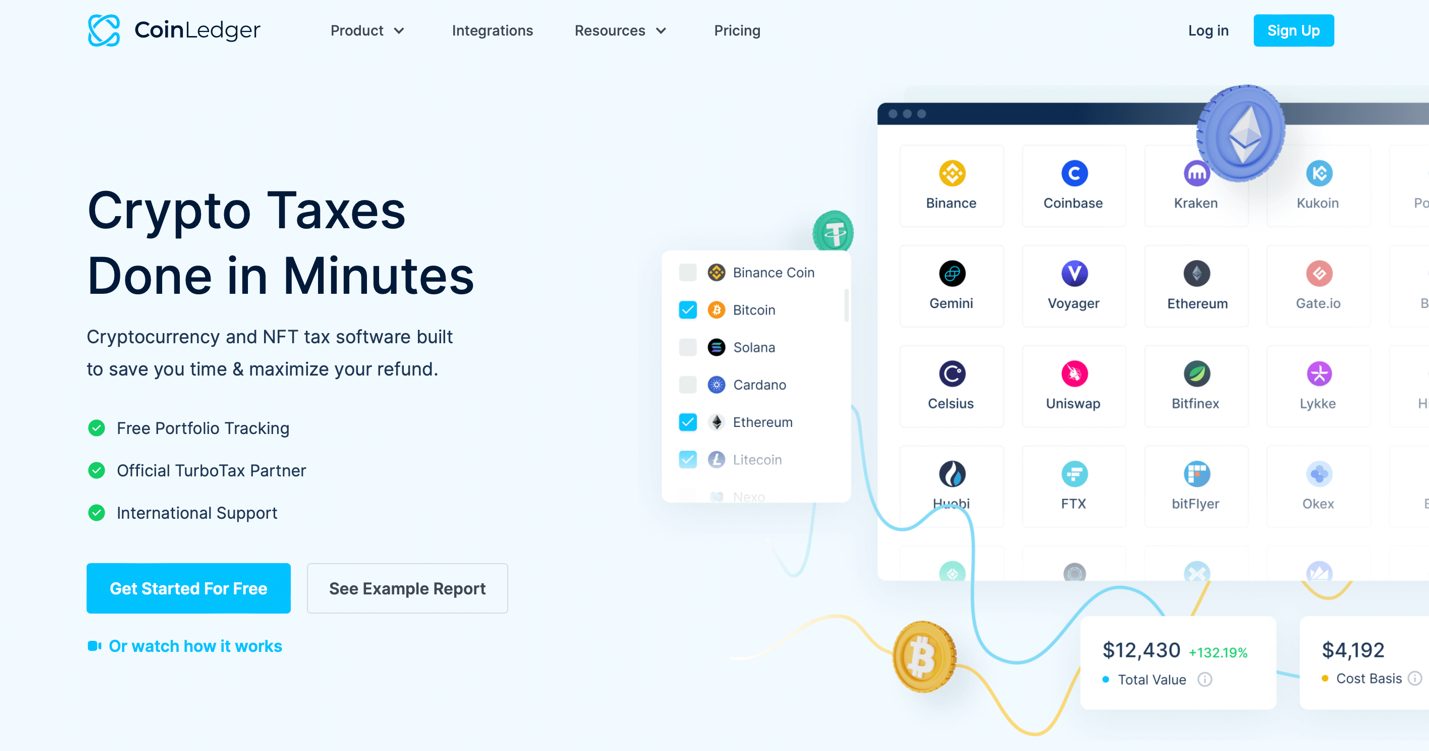

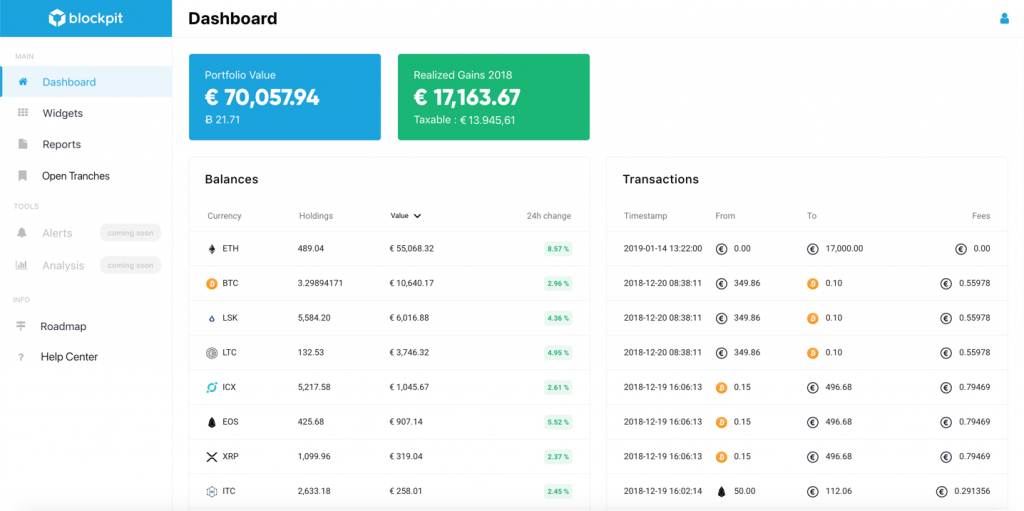

A crypto tax calculator is a software solution that helps you calculate your crypto profits losses income and tax liabilities. Expanding on the capabilities of the EY CryptoPrep tool released in summer 2020 this new tax calculator imports transactions from numerous major cryptocurrency coins and. Easily Calculate Your Tax Obligation ZenLedger August 29 2022 Everything You Need to Know About Crypto Loan Taxes Like all cryptocurrency.

To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or loss and compare your tax outcome of a short term versus long term. LIFO Last-In-First-Out According to the LIFO. Youll need to know the price you bought and sold your crypto for as well as your taxable income for.

The short-term capital gains tax is fairly simple to calculate. Bitcoin Tax Calculator. How to use Fisdom cryptocurrency tax calculator.

Lets calculate the tax in the above example. A cryptocurrency tax calculator is a software that helps you to calculate the value of tax which is liable to pay for the gains under the crypto transactions. Crypto Tax Calculator More Features Coming Soon 1.

Head of household. Its important to remember that cryptocurrency trading is taxable and must be included in your tax return. Hold Your Cryptocurrency in an IRA In a traditional IRA your deposits are not included in your taxable income but youll be taxed on gains and withdrawals.

Cryptocurrency calculator is a very. You can estimate what your tax bill will look using the calculator below. We have done tax calculation for all customers who have traded with us in 2021.

Use our crypto tax calculator. In the calculator below we calculate your capital gains by subtracting your cost basis the. During this webcast KPMG tax professionals Pete Ritter Tony Tuths Joshua Tompkins and Hubert Raglan will highlight current events in the cryptocurrency industry and.

Crypto Taxes Usa 2022 Ultimate Guide Koinly

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Cryptocurrency Tax Guide 2022 How Is Crypto Taxed In The Us

Crypto Taxes How To Calculate What You Owe To The Irs Money

Crypto Tax Calculator Personal Capital

Understanding Crypto Taxes Coinbase

Cryptocurrency Tax How Is Cryptocurrency Taxed Zenledger

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Best Cryptocurrency Calculator Mining Profit Taxes

The Beginner S Guide To Crypto Taxes 2022 Coinledger

How To File Taxes On Your Cryptocurrency Trades In A Bear Year Techcrunch

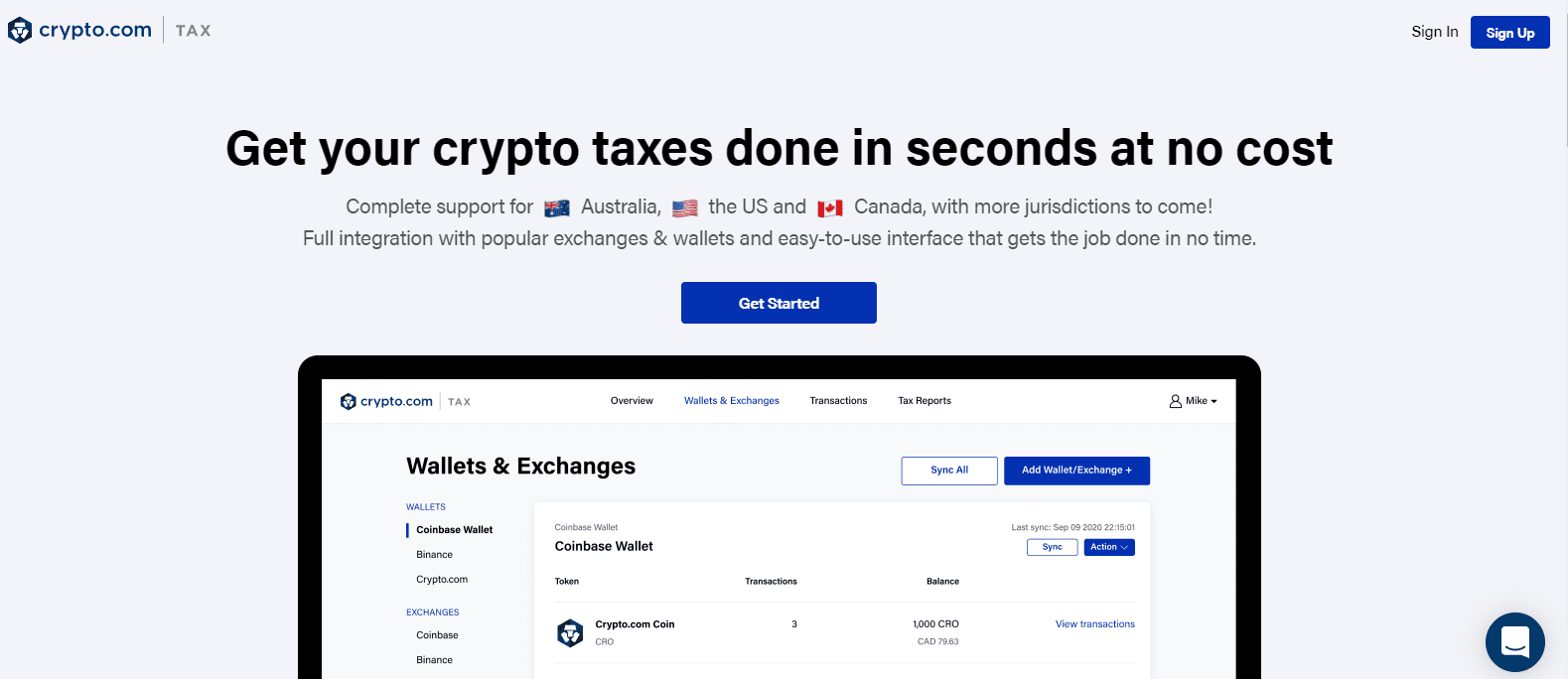

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

Coinpanda Free Bitcoin Crypto Tax Software

Cryptocurrency Tax How Is Cryptocurrency Taxed Zenledger

Cryptocurrency Tax Calculator 2022 Fully Updated

Cryptocurrency Tax 101 Intro To Capital Gains And Crypto Tax Treatment By Blockfi Blockfi Medium

How To Answer The Virtual Currency Question On Your Tax Return

Cryptotrader Tax Easy To Use Cryptocurrency Tax Calculator Cryptopolitan